The administration of one’s finances plays a significant role in daily life. But only some have the time or the skills to handle their funds properly. And even if someone has the time and expertise to manage their costs, they choose not to because they find it tiresome and time-consuming. You may now use an expense manager that will assist in managing your money, so you don’t have to worry about keeping track of your expenses.

An expense tracker is a piece of software or an application that assists in maintaining accurate records of your money coming in and going out. In India, many individuals rely on fixed incomes and discover that they run out of money around the end of the month. While a low wage may contribute to this issue, ineffective money management is almost always to blame.

Without recognising it, people frequently overspend, which may be harmful. You may track how much money you spend every day and what by using a daily expense manager. You’ll get to know exactly where your money is going at the end of the month.

Here are some advantages you should be aware of if you’re not sure why you should be using a daily spending manager:

- Put Your Spending In Order:

Remember that you have a fixed salary and only a certain amount of money to spend. You can prioritise your spending if you consider what you spend your hard-earned money on. By doing this, you will avoid making unnecessary purchases and limit your expenditures to the items you need, such as paying your EMIs, debit card spends, utility bills, rent, and groceries.

- Recognise Your Bad Spending Habits:

Using an expenditure planner will enable you to see your spending tendencies. You can make changes after seeing this expenditure in black and white. You will initially hesitate before spending money on items you don’t need.

- Recognise Fraud:

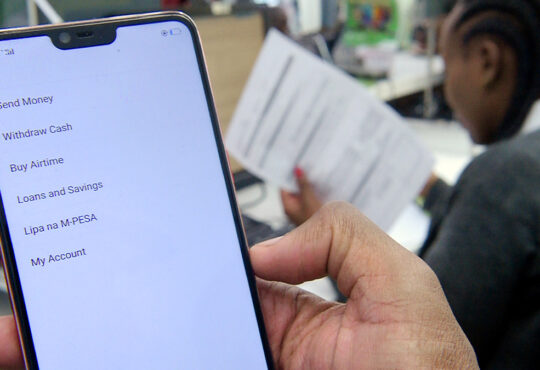

You must keep close tabs on your credit card bills, bank accounts, and expenditure as India gradually transitions to digital payment and using a digital bank. Otherwise, you risk being a financial fraud victim without realising it. It may be terrible and challenging to recover if your money is taken due to poor financial management.

- Take Charge Of Your Money:

You take charge of your money when you keep track of your spending. It allows you to restrain your spending urges and cut unnecessary expenditures, helping you stay out of debt. Instead, you might strive to achieve financial stability by managing your money better.

- Investment And Saving:

You can better save and invest for the future when you keep track of your spending. You can’t save and support the end if you spend money carelessly.

A daily cost manager should be used, well, every day. By keeping track of your spending, you may not only save money but also set financial objectives for yourself to help you save money for any emergency in the future.