We are not required to give specific information when applying for a personal loan online; the reason can be anything. We have the option to borrow money for urgent medical expenses, purchase a sizable asset, or remain anonymous. They also create challenges by lending to new people, businesses, and other entities. In addition, many financial institutions primarily derive their income from the monthly interest and fees associated with online loans.

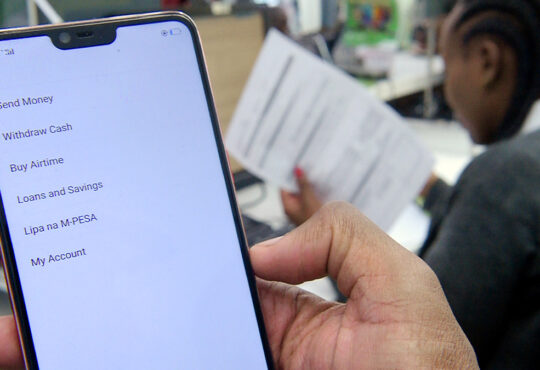

An instant lending platform’s features include the following:

- All loan-related documents, including the loan summary, repayment schedule, monthly credit card bill, no-due certificate, and more, are viewable and downloadable in a special section of the instant loans app.

- Most online personal loan lending apps give users a variety of payment methods to choose from. In light of this, we can easily pay our monthly installments online using a debit or credit card, net banking, IMPS, or UPI.

- An online platform for personal loans allows borrowers to view loan information such as EMI, due date, and loan term.

- There are no hidden fees or paper requirements for the loan application process. Lenders also guarantee complete transparency. Borrowers obtain Flexi personal loans from NBFCs or banks that have received RBI certification.

How Can I Get A Personal Loan?

There are a few simple steps we must take to apply for a quick loan through an app, and they are as follows:

First, download the lending app to your phone and install it.

Then, sign in to the app by entering your email address and mobile number during registration.

Check your eligibility for a loan by entering some basic information.

Send in your required documentation to complete the online verification and KYC process.

Then use the online lending platform to apply for a quick loan.

The money is transferred right to your bank account when your loan application is accepted.

Different Loans They Provide:

- Individual Loan:

Instant personal loans are available online for all our needs, including unforeseen medical expenses, weddings, small businesses, education, travel, and two-wheelers. With little documentation, we can apply for personal loans online up to a certain amount. The borrower’s credit score determines the loan amount.

- Loan for home appliances:

We can obtain a loan for home appliances like TVs, refrigerators, air conditioners, and many others with low EMIs and flexible terms through the lending app.

- The EMI Card

We can apply for an EMI card on most virtual lending platforms and receive quick approval. So, we take advantage of having a specific credit limit and use the money to purchase goods at thousands of partner stores across India.

- Loans for online purchases:

The app offers EMI plans that allow us to purchase and pay for items later. We can also shop on e-commerce sites. To approve our loan for an online purchase, they require our PAN card and address verification.

Online personal loans are available for salaried and independent contractors. To be eligible for the loan, borrowers must be Indian citizens at least 18 years old, have a consistent monthly income, and have a minimum CIBIL score. However, most online lending apps now have credit models that allow them to make better offers regardless of the borrowers’ credit scores.