Hundreds of Indians travel worldwide to explore new educational opportunities, jobs, and business opportunities. One requires money to survive on distant lands, and it is not unexpected that sending money from India has increased in recent years.

If you need help transferring money abroad, you have landed in the right place. Keep reading to know in detail.

Basic rules for sending money abroad:

- The only way for Indian citizens to transfer money abroad is via netbanking. The Reserve Bank of India (RBI) has established an outbound remittance procedure to make a payment overseas, following the guidelines of various foreign legislation.

- A digital payment gateway, a bank, or the post office are all options for making an external remittance.

- A person or organization can send $250,000 from India to another country every year for medical treatment, education, business travel, leisure, gifts, donations, and other essential expenses of relatives living abroad.

Required documents:

- PAN card: Permanent Account Number

- Original bill/receipt/fee slip, and so on.

- Evidence of sufficient funds or savings

- Form A2

Essential factors to consider:

Here are the factors that you must take into account while you send money abroad from India.

- Exchange rates:

When converted to another, the value of one currency is known as the exchange rate. When sending money abroad, you must pay the exchange rate.

- Transfer speed:

Generally, an abroad transaction takes 48 to 72 hours. However, the transaction may take four to five working days when you are sending the money through a demand draft or cheque.

- Overhead fees:

When sending money abroad, you will often be charged a transfer fee, foreign conversion tax, and occasionally service tax.

How to transfer money abroad?

We all have seen how fast online bank services are becoming popular nowadays. There are several options to transfer money worldwide. The choice you select for sharing money will depend on the amount being sent, the urgency of the situation, and the currency of the country where the recipient stays.

If you are unaware of all the choices you got to transfer money, take a look at the points listed below:

- International money order:

Money orders were first the most popular method of money transaction. Money orders must be deposited into your bank account to be cashed at any check-cashing outlet. It is one of the inexpensive and secure ways to send money overseas.

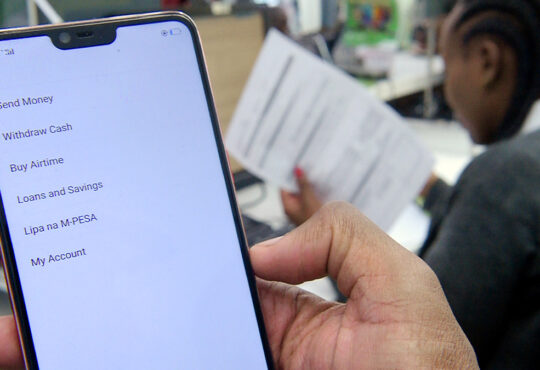

- Online wire transfer:

An online wire transfer is one of the newest methods for sending money abroad. Various financial companies, including Western Union, Book My Forex, etc., offer online wire transfer services. Due to the involvement of the intermediary institutions, this procedure is very inexpensive and secure.

- Bank draft:

This online payment method is affordable and secure. It is a great way to send money overseas. Most banks sell bank drafts that you can purchase in the currency of the recipient’s country. The main disadvantage of using a bank draft is that it takes longer than other transfer methods to be fully completed.

Online money transfer is a simple technique most Indians use to send money abroad. Information about the account holder, the destination bank’s details, and other specifics are needed for this process. As the intermediator banks are not included in this procedure, you might have to bear considerable overhead costs.