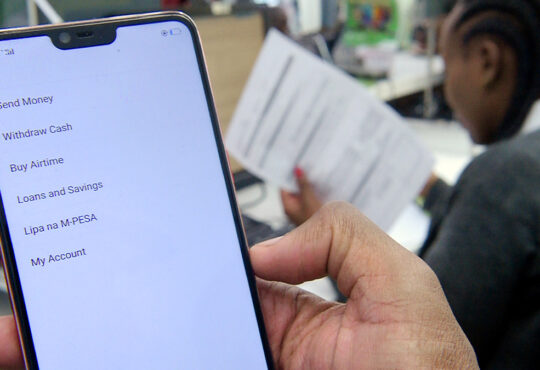

Loans and earlysalary how you oversee them are the main components of your credit. In any case, credit is complex. Depending upon the condition of your credit, loans can either help or impact your FICO ratings.

A new or existing finance loan can influence your credit in more than one way:

- They assist you with building credit on the off chance that you effectively make installments.

- They impact your credit if you pay late or default on loans.

- They lessen your acquisition capacity (which may not straightforwardly influence your credit scores).

- So they make a slight impact on your credit right away. However, loans can undoubtedly recuperate if you make installments on time.

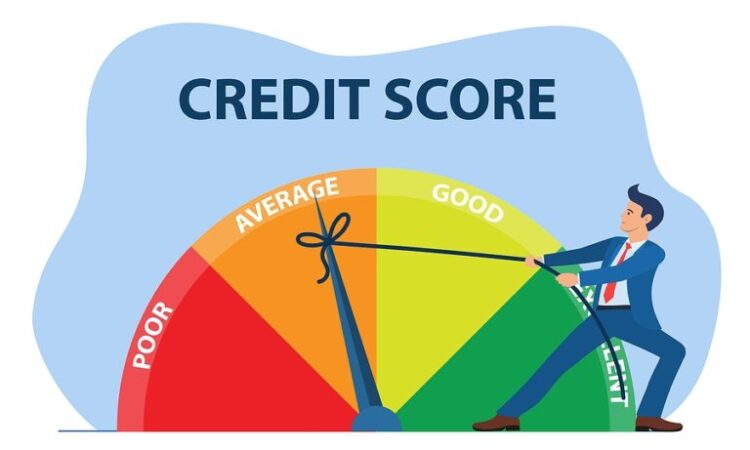

How Building Credit Works

Your credit is about your set of experiences as a borrower. Assuming you’ve acquired and reimbursed credits effectively before, moneylenders accept that you’ll do likewise later on. The more you’ve done this (and the more you do it), the better.

Taking out instant money offers you the chance to reimburse effectively and develop your credit. How much obligation you have, including the loans you take out, decides 30% of your financial assessment. How dependable you are at taking care of that obligation, known as your installment history, makes up 35% of your FICO assessment. Luckily, if you have awful credit—or you have not yet settled credit—your financial assessment will improve with every month-to-month on-time installment.

Getting various sorts of loans additionally helps your credit. A modest amount of your FICO rating depends on your “credit blend,” which checks out the assortment of records on your credit report. No matter the situation, You can have a decent score assuming every one of your loans is Visas, yet your blend is better if you likewise have an automobile loan or a home loan.

What Missed Loan Payments Mean for Your Credit

Taking out loans can further develop your credit blend and extend your acquiring history, the two of which can further build your credit. Assuming you pay late or quit making installments, notwithstanding, your credit will endure.

Missed installments and outstanding obligations both contrarily sway your financial assessment. When your score drops, you will make more complex memories of getting new loans. Assuming you begin to experience difficulty making installments converse with your moneylender. You might have the option to arrange your financing cost, renegotiate your advance, or solidify numerous loans to bring down your regularly scheduled installment.

Try not to get only for attempting to develop your credit further. For example, assuming you acquire the cash that you can’t repay, you will wind up impacting your credit score. Instead, utilize the right loan for the circumstance if and when you want to.

What New Loans Mean for Your Ability to Borrow

New loans influence something other than your FICO rating; they additionally decrease your capacity to acquire. Your credit reports show each advance you’re at present utilizing, just as the necessary regularly scheduled installments. Assuming that you apply for another credit, loan specialists will check out your current month-to-month commitments and conclude whether or not they figure you can manage the cost of an extra installment.