Isn’t it difficult to live far away from your loved ones and have difficulty sending money across the border? What if the barriers were removed and you could transfer money in a matter of seconds?

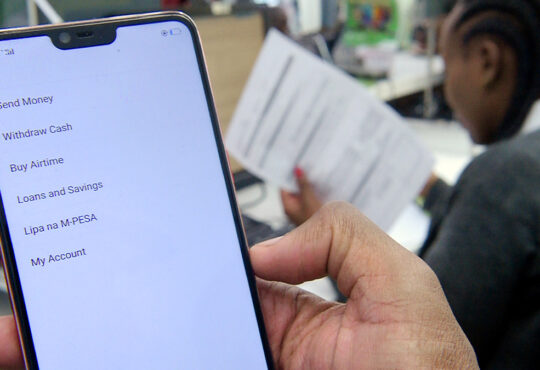

With fast internet connections and easily accessible electronic devices, it is no longer necessary to visit the bank every time when you can deposit and receive money in a few clicks. These apps are simple to use and user-friendly for bank transfers.

These free money transfer apps use virtual cards to provide privacy and security. A virtual card is a digital debit/credit card that functions in the same way as a physical card. In many ways, virtual cards are similar to traditional bank cards, with the exception that they are digital rather than physical.

The primary purpose of virtual cards is to secure transactions. Since each virtual card contains a unique set of 16-digits, virtual cards are safer than physical cards. Furthermore, they have a wide range of applications. Like making online payments, bills payments, and shopping, easy virtual card management directly from the app, and instant notifications once transactions are posted. Furthermore, virtual card transactions are much faster to process than physical card transactions. You can shop whenever and wherever you want with multi currency wallet available on the app. In the event that a third party decrypts your virtual card number, it’s indeed simple to delete and recreate it. There is no need for clients to wait for replacement cards, making this an excellent option. Customers can also have multiple virtual cards active simultaneously, as opposed to just one physical card.

What are the tremendous benefits of using a virtual card?

- Time-efficient

Physical cards can take days to arrive at your home, and if you lose your physical card then unfortunately you will have to wait for a replacement, whereas you can obtain a virtual card instantly with a few keystrokes and mouse clicks.

- Simple to use

You can easily create a virtual card in an instant, and they are also simple to use. You can simply freeze the card once you’ve finished using it.

- Make several virtual cards at the same time.

You can manage your spending by using different cards for different types of expenses by using up to three virtual cards at once.

- Are virtual cards more secure?

Virtual cards cannot be stolen or lost, whereas physical cards can be stolen and used fraudulently. In addition, a virtual card’s information is restricted to a single purpose, ensuring the confidentiality of the company’s original account and debit card number and credit card number.

Money transfer apps are secure and safe to send money online. Transactions are encrypted, and bugs are fixed on a regular basis. Furthermore, the majority of smartphones are now protected by the owner’s password or fingerprint. This means that even if someone stole your phone, they would be unable to access the money transfer app and commit financial fraud.

If you suspect that your virtual card has been compromised, you can simply freeze your account, effectively stopping fraudulent activity at the source.