The days of borrowers having to jump through hoops to obtain an urgent loan are long gone. In the digital age, everything is just a few clicks away. Numerous quick loaning applications now provide loans directly through your phone in light of the rising demand for credit. The outdated conventional financial product modernizes to meet the needs of various segments.

Stress-free Application Process:

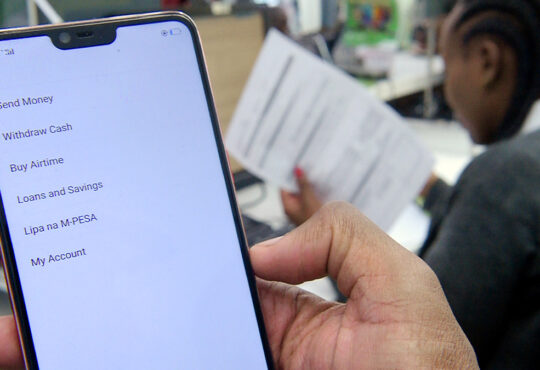

With the development of web access in India, a cash loan app is, in a real sense, a versatile bank. You can get to it in a hurry. Assuming you are at any point in a crisis, you know where precisely to find support from. Open the Play Store/App Store, find a solid cash loan app, and give the imperative records. Similarly to this application, you want to give just the location and personality verification with the most recent three-month bank articulation. There is no security required, subsequently zero administrative work.

Saves the cost of shoes:

Amid monetary crisis, there is enough at the forefront of our thoughts, and going around for cash can be the most frightening experience of all time. Loan applications save this time as the whole application and documentation process is generally on the web. They are accessible nonstop, so whether you are traveling, or working, you need an internet connection as the applications are with eKYC. There is no requirement for actual branch visits. Cash is with you not long after your loan application is all right.

No outsider

The significant benefits of borrowing cash loans through apps are security and privacy. OTPs certify your requests and transactions. There is no chance that your personal information will be lost. With a strong password, you can protect the app’s data. Lenders use encryption to protect data. With the help of in-app permissions, you can make sure that you share just what is essential.

Monitor your transactions: Loan apps offer complete transparency. It is possible to track each transaction and EMI. You can get reminders for payments and view the amount of outstanding debt and scheduled payment dates. It is the ideal technique to also document the direct EMI withdrawals from your checking account.

No impact on credit rating:

An immense danger of borrowing from other sources is that your credit score could lead to their rejection of your loan application. When you switch lenders, and they check your credit report, the issue gets worse. Your credit score may suffer if you repeatedly request access to credit reports. However, you may review your eligibility and assures you of loan sanction with quick money lending applications. In addition, it makes sure that your credit report and information are only from one source.

One app to rule them all:

Mobile loans, weddings, rent, car, schooling, electrical equipment, etc., can be obtained using a quick cash loan from the loan app. You can use the money for pretty much anything. You may even use it to travel the world or finance your enterprise!

Even if we all budget every cent of our earnings, financial emergencies and budget slip-ups are always a distinct possibility. A rapid money lending app can assist all your personal loan needs. Any expense, including medical emergencies, vacations, credit card bills, home renovations, tuition, and much more, may be covered by this loan. Therefore, relax and download the loan app to receive a fast money lending loan online.