Keeping a steady income is significant for many organisations and availing money loans in the future. The organisation requires critical working money to run business exercises and further develop benefits. For example, it may be essential to buy new gear, prepare and hold individuals, or gain extra property. Accordingly, organisations need financing for their organisation.

Many organisations utilise different choices in the credit business to supply their monetary necessities. The various loaning decisions of a finance loan that are open to finance managers incorporate Non-Banking Financial Corporations, conventional banks, government organisations, and even group subsidising.

The following are instances of the advantages of business credits and how these advances can be monetarily gainful for you:

Expanded Funding, Increased Promotions

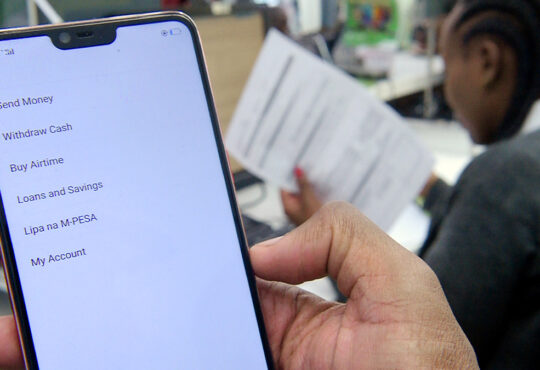

It’s a widespread longing, all things considered, to have their image name become a web sensation via web-based media. However, when you have the cash or a particular salary, you will have more freedom to advance yourself through a salary loan app, use advertising techniques, and utilise viable advertisements.

Adaptability

Borrowers might take out advances to assist them with arriving at their organisation objectives. Entrepreneurs might apply for a long time in fulfilling monetary necessities, though a quick advance has a particular time. In picking the span of their glory, entrepreneurs decide between business, individual, and blended-use. While present moment (one-year) advances are the most well-known, they can stretch for as long as five years or longer.

Obligation-free

By and large, there is no compulsory necessity that a business borrower should have security or a specific pay level through salary loan online before applying for an advance. However, for a limited scale business that is simply beginning, it also will be very beneficial in satisfying the business needs and at the same time guaranteeing economic advancement.

Some elective money associations, like NBFCs, don’t expect you to give security to your business advances. Instead, it pushes the boundaries for microbusiness proprietors to get the financing they need and allows them to remain in the venture.

Simple access

The rate at which the regularly scheduled instalments can be incrementally or reduced depends on whether the borrower can gain admittance to cash or create gains every month.

The loan fee that individuals can manage

Banks and NBFCs give cutthroat financing cost credits to organisations. The term, the advance, guarantee, and financial soundness all affect the financing cost of advances.

Furthermore, NBFC credit choices with no pre-instalment punishment and with next to no handling charges are accessible. Along these lines, borrowers can save money on their loaning costs by exploiting modest advance rates and ostensible handling charges.

Reimbursement choices that are adaptable and helpful

Flexible reimbursement options are accessible for business financing. That implies the business will want to reimburse the credit without any problem rapidly. Their business viability will permit them to sort out a reimbursement plan customised to their requirements. Indeed, sometimes repeating instalments may be diminished or brought up in agreement with productivity.

Furthermore, there are straightforward techniques for reimbursement choices. For example, you can take a crack at the auto-charge administration by moving cash utilising Electronic Funds Transfer (EFT).