The forex market is a global and decentralized marketplace that trades 24 hours per day, five days a week. The currency pairs in the forex market are sold in different time zones. Forex traders need to be aware of the risks involved in trading currencies, especially those who trade without an experienced broker or financial advisor.

In this blog post, we will review ten top-rated brokers to choose from based on your needs and level of experience.

Brokerages are ranked based on several factors.

Let’s look at the reasons a brokerage may rank high:

– Customer service offered by the company and its representatives – The broker’s trading platform offerings, such as education or mobile tools

– Ease of use for newcomers to forex trading who want to buy low and sell high with little hassle

So without further ado, here is our list from best-rated brokers!

Top Brokers: FXCM, CMC Markets, IG Group, City Index, ETX Capital. As you can see, there are many choices out there! If we were to recommend one, it would be CMC Markets.

Forex trading is the buying and selling of currencies. Forex traders buy low and sell high, hopefully making a profit on each transaction. The goal for forex traders is to get in at the right time, which is before an event that will affect currency prices happens.

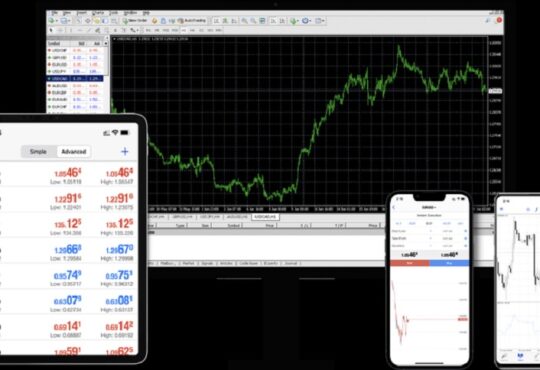

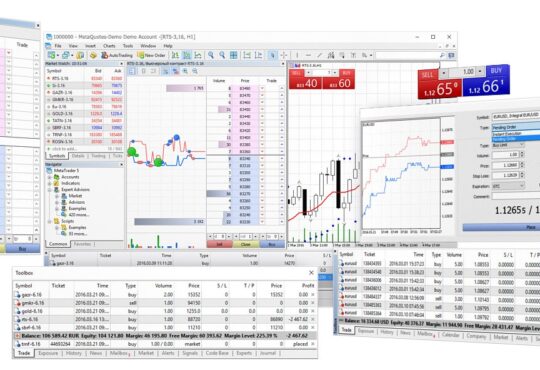

There are two main ways that people can enter into Forex trading: through brokers or using software.

The broker option requires less capital investment upfront than going with a software package, but does come with some limitations-such as having limited access to real time charts and not being able to customize your order execution parameters (for example whether you want your orders executed at current prices only or whatever price happens to be available).

Using software allows more freedom of customization, and there may be fewer delays in execution.

If you are a beginner trader who is just starting out on Forex trading it would be best for you to start with the software option as this will give you greater flexibility when learning how to trade; if your goals change then moving onto brokers can always happen later.

If you are thinking about investing in Forex Trading South Africa, then here’s what you need to know:

– There are many factors affecting exchange rates other than just economic strength or weakness: political instability, natural disasters, changes in interest rate levels from central banks can all have dramatic effects on how much one currency costs relative to another.

This makes forecasting trends wildly difficult and creates opportunities when these unforeseen events happen because they significantly alter market expectations for future price levels.

– Forex traders’ profit from market inefficiencies and can capture liquidity when markets move because they trade currencies on a global scale, while their counterparties may only be selling within one country or region. This factor also dictates the need for forex traders to monitor events happening outside of their geographical area and those that occur locally.

Now that we’ve given you few tips on Forex Trading South Africa as well, you can check their official website Forex Trading SA and find out more about the top traders there!