Trading the forex market can be a very lucrative venture if done correctly, and those understanding the trends in the currency markets often enjoy great success. Many traders spend countless hours analysing charts, economic data, and industry news to develop a consistent trading plan to potentially generate profits while minimising risk. But what does it take to pull off an excellent forex trade?

In today’s article, we will dissect each component of a successful trade, from entry points and stop loss levels to exit strategies and money management plans – all so you can see exactly how profitable trades occur. Forex markets don’t have any secrets; only those who know what they’re doing succeed. So, let’s dive into the anatomy of a great forex trade.

Understand the Basics of Forex Trading

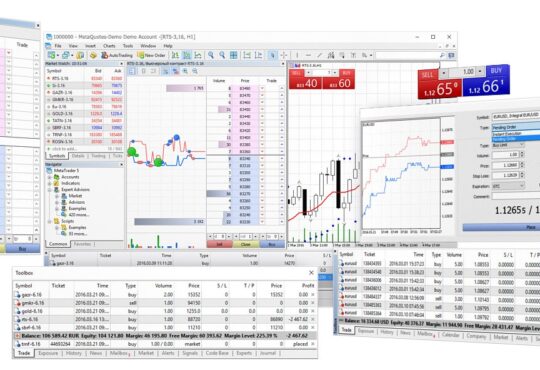

Forex trading, or foreign exchange trading, is a complex yet potentially rewarding field of investment. Understanding the basics of forex trading is essential for those looking to dabble in the market. Essentially, forex trading involves the exchange of one currency for another, bought and sold via various platforms such as banks, brokers and online trading platforms. The value of a currency is determined by a multitude of factors, including geopolitical events, inflation rates and market sentiment.

As with any investment, successful forex trading requires knowledge, expertise and market research. Traders must familiarise themselves with the terminology and concepts of forex trading to make informed investment decisions. While forex trading can be daunting for beginners, with the right resources and support, it is possible to navigate the market and increase the potential for returns.

Set a Trading Plan

One of the critical components of a successful forex trade is having a solid trading plan in place. It includes defining your goals, risk tolerance and preferred strategies for entering and exiting trades. A well-defined trading plan helps traders stay disciplined, avoid emotional decision making and stick to their strategy even when volatile market conditions.

Before placing any trades, it is essential to have a thorough understanding of your chosen currency pair and the factors that can influence its movement. It includes analysing technical indicators, economic data releases and global news events. By having a clear plan in mind, traders can feel confident in their decisions and be better equipped to identify profitable opportunities.

Research Wisely

A thorough market understanding is crucial for any trader looking to make well-informed trades. It means keeping up-to-date with economic data releases, monitoring trends, and analysing technical indicators to identify potential entry and exit points. In addition, traders should conduct thorough research on their chosen currency pairs, staying informed on any political or economic events that could impact their trade or pose forex risks.

However, it is crucial to be mindful of where you obtain your information from. With the rise of fake news and misinformation, traders should ensure that their sources are reputable and unbiased. It can also be helpful to follow experts in the field and learn from their insights and experiences.

Execute Your Trade

Once a thorough analysis has been conducted and a comprehensive trading plan is in place, it is time to execute the trade. It involves placing an order with your broker or trading platform and carefully considering the various order types available (such as market or limit orders) to ensure optimal execution.

Additionally, setting appropriate stop-loss levels and profit targets is crucial. These levels should be determined based on your risk tolerance, considering market volatility and potential reward. By setting realistic and achievable targets, you can effectively manage your risk and maximise potential gains.

Traders must remain disciplined throughout the trade execution process and stick to their plan. Emotions can often cloud judgment, leading to impulsive decisions resulting in losses. By adhering to a well-defined trading plan, you can mitigate the impact of emotions and make rational decisions based on your analysis and strategy.

Monitor Your Trade

After executing the trade, traders need to monitor their positions regularly. It means monitoring market movements and being prepared to adjust stop loss levels or take profits if required. It is also essential to stay informed on any market news or events that could impact the trade.

In addition, having a journal to record your trades can be beneficial in evaluating your strategy and identifying areas for improvement. By tracking your trades, you can learn from both successful and unsuccessful trades, allowing you to refine your approach and become a more skilled trader.

Close Your Trade

The final stage in the anatomy of a great forex trade is knowing when to close the trade. It involves keeping a close eye on market conditions and preparing to exit the trade if necessary. It could be due to reaching your profit target, hitting a stop loss level or simply because market dynamics have changed.

Traders must remain disciplined during this stage as well and not let greed or fear drive their decisions. By sticking to your trading plan and managing your risk, you can ensure a successful close to the trade.