It is common for students to borrow new loans each year after getting enrolled. When the repayment period catches up, they may be juggling numerous monthly bills, each with different interest rates. This can be overwhelming. A good way to manage the student loan debts is through consolidation and refinancing. However, managing any loan debt through these options can feel like you’re doing a full-time job. Your capability of doing one or the other will depend on the loan type, the budget as well as your repayment goals.

Consolidation and refinancing student loans can be a smart move because the monthly payments might be greatly reduced. But, before you make this decision, it pays a lot to take a look at how they work and how to go about it.

Consolidating and Refinancing: At a Glance

In the realm of student lending, these terms are often used a lot. Even though they are different, both of them are used for a common aim which is paying the student loan debts smoothly by enabling merging of many loans to one loan so as to have only a single payment each month.

However, the major difference is in what every option can help you achieve. Refinancing is mainly opted to save some cash since the interest rates are reduced on either private or federal student loans. On the other hand, consolidating helps to gain control of the federal loans.

➢ Student loan consolidation

Debt consolidation is taking out an online personal loan to completely pay off any existing debts. Consolidating and refinancing student loans is used interchangeably. But, if it’s federal student loans, they are very different. Consolidating is combining many federal student loans to get one from the government. No need for credit approvals, and what you get is a Direct Consolidation Loan.

When it comes to private loans, consolidation will occur when refinancing them. Here, you work with a private lending company, and you need to make sure you meet the eligibility requirements to be approved. You will get a new loan with one rate and it can be variable or fixed. You will get new terms of repayment, either longer or shorter term. A longer-term implies it will take longer to complete repayment because the monthly payments are lower.

If you have many federal loans, consolidating them into a single direct consolidation loan is helpful. Remember, federal loans that are consolidated via direct consolidation loans will still be federal loans. But, you will now have one new federal instead of the multiple ones you had.

➢ Student Loan Refinancing

Refinancing is the process of consolidating all your student loan debts with a private lending firm and getting newer loan terms and interest rates. This procedure varies from lender to lender. However, the main idea is that the borrower will consolidate the student loan with a new one. The qualifying borrowers may easily get low rates.

When a private lending institution consolidates your loan, they’ll be refinancing it. However, not all lenders agree to loan refinancing, and some firms only consolidate and refinance both private and federal student loans. Basically, the private loans are the ones received from the NBFCs, such as the NBFC in India for Indian students.

Before a lender agrees to refinance the loan, they will check your credit history score and other financial details. This will help determine the applicable rate and loan terms for the borrower. But, the requirements vary from one lender to another.

Further, the fees for refinancing student loans are normally determined by the particular lender. Interestingly, there are other lenders who don’t have the hidden fees while refinancing the loan. Based on your current financial situation, you may get a new lower rate. Those with excellent credit scores and history might be lucky to get a new loan at lower interest rates.

How to Consolidate/Refinance Student Loans?

Getting the best lender when consolidating and refinancing your student loans is important. To do that, you need to shop around. Set aside time to look for various lenders and compare their rates. Then, you will be able to make a choice.

Here are steps to consolidate and refinance student loans;

Step 1: Look for the right lender to refinance the loan: Most often, the lender provides offers that usually cater to various situations and needs. You will find some lenders refinancing international student loans while others accept loan refinance for those who did not get the degree.

Step 2: Compare the rate offers from different lenders: Different lenders have different interest rates for loan refinancing. You can provide some of your personal details to prequalify for the loan. The best part is that it doesn’t affect the score.

Step 3: Select the loans and terms of the loan: After choosing the rate you find suitable, whether variable or fixed, now choose the repayment terms. All these factors may affect the monthly payment and the cost of the loan.

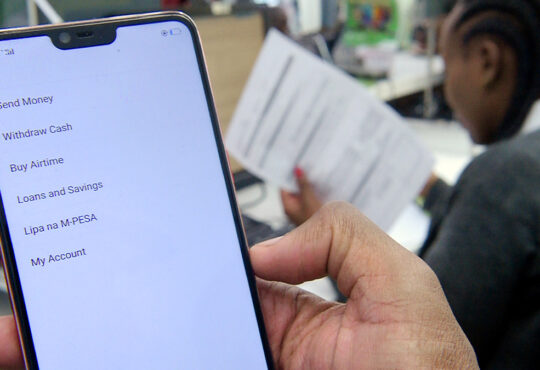

Step 4: Apply: When you’re comfortable with the offer of the loan, you should formally apply for the loan. There are many best loan apps, you can apply for the loan. Besides, lenders these days have provided apps to apply for loans conveniently.

When your loan is approved, you will provide the needed documents and then wait to get the new loan to consolidate your student debts.

Conclusion

Consolidating and refinancing a student loan is one of the best options to easily manage large debts. The benefits that come with it are low rates. Besides, you will be able to pay the debt since it’s only a single payment. But make sure you know the costs and the savings you will get when you refinance your loan.

Getting a loan to consolidate and refinance your student loans shouldn’t be hectic. There are numerous personal loan apps where you can get a new loan. Thorough research is what you need to do beforehand.