The fintech wave is fast spreading as we see many continents worldwide becoming the flag-bearers of this innovative advancement that has taken the world by storm. In simple words, fintech is the fusion of technology and innovation to provide financial solutions to people from all walks of life. It is not limited to individuals or business organizations only. Still, the key element has been a constant catalyst in bridging the financial inclusion gap in recent years. Digital banking has undoubtedly changed how we handle our finances, and we are literally getting things done at our fingertips.

Superpowers from the West, especially Americans and Europeans, have remained at the helm of driving world economic growth with their early adoption of the fintech revolution as they are the pioneers of introducing credit and debit cards to the world. However, in the past few decades, the burgeoning desire of other nations worldwide to be active players in the broadening field of the fiscal arena pushed countries like China and others from Asia. Africa also hopped on the bandwagon without delay, providing a refreshing contrast to its banking sectors.

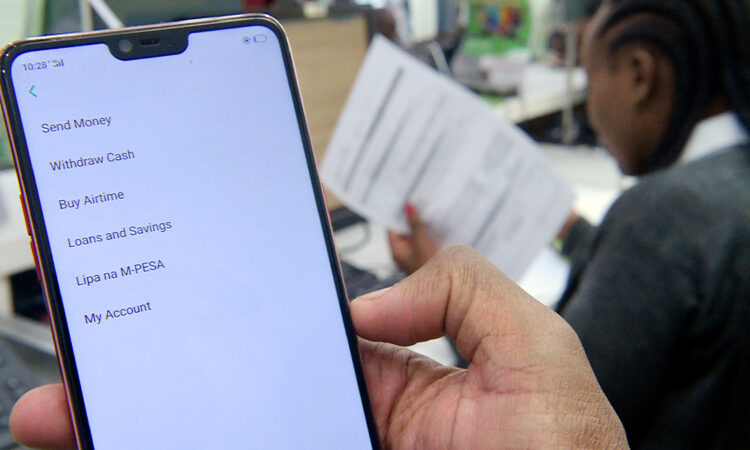

The banking industry in Africa has been working leaps and bounds for the past few years to provide mobile-first services to all users who prefer going digital. Mobile broadband networks are rapidly growing, covering more than seventy percent of the total population, signaling huge internet penetration among the masses, thereby promising higher chances of success for mobile-based banking apps. Kenya has been the central avenue of this digitization process, where disbursements of KYC documents and loan apps Kenya banks offered were digitized first.

This digital revolution has paved the way for various regional commercial banks to reach out to their customers and offer them digital financial services more effectively. It has also helped banks leverage this digital autonomy to grow their balance sheet. Whether investing money, applying for an online loan, or using a secure payment platform like Pesalink to make and receive payments, Kenyans did it all within the comfort of their abodes. Later on, blockchain technology was also introduced within the Kenyan banking systems to secure the payment infrastructure with an unbreakable layer of security the blockchain provides due to its decentralized nature.

With this simplification of banking transactions, it is no longer a hassle to buy goods, services, and products online in Kenya, as E-commerce is the consumer’s favorite marketplace these days, not just for actually buying goods but also for window shopping through their screens to check product price, availability, and other shopping related concerns.

The rate of financial inclusion, which stood at 26% in 2006, has now crossed the mark of 83% among the population with access to basic financial services, such as the options to buy airtime Kenya mobile operators have to offer and pay instantly for that. Kenya is the definitive exemplar for other African countries, and there are several actionable themes that other countries should note from Kenya’s Fintech success. The massive impact of the fintech revolution has immensely elevated the performance of various financial institutions across the globe and, this time, for Africa as well.