Digital transformation has made it possible for banking services to get offered in the comfort of an individual’s home or space. Various measures have been put in place to protect the bank account owners from fraudulent activities that might make them vulnerable to theft, among other crimes. The safety measures assure online bankers of a safe and secure accounts handling process, giving them peace of mind to enjoy the online banking services. Fidelity Bank provides reliable digital business banking services which enable businesses to manage their finances on the go.

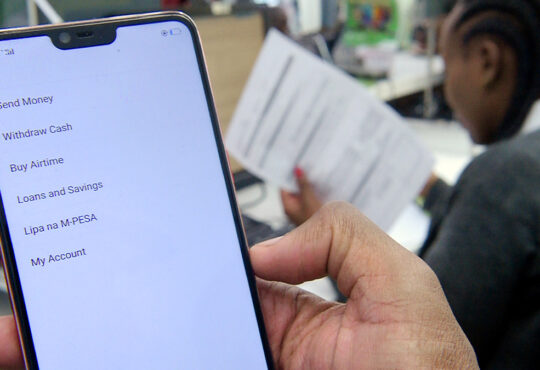

Online banking enables bank account users to check their accounts, pay bills, initiate wire transfers and ACH, and approve transactions without necessarily visiting the bank branches. Online banking enables individuals to manage their banking activities anywhere on their phone or computer. Online banking has several advantages for businesses, such as adding multiple users with customized account access and easy and faster movement of money through originating ACH transactions and wire transfers. Additionally, companies get to protect their information using Positive Pay, ACH Filter, and ACH Block. The various features that come with online banking include:

Digital wallet

The digital wallet lets businesses securely take their cards anywhere through mobile devices. This feature offers several advantages to the user, such as the possibility to make contactless payments from the mobile device. Additionally, the digital business banking wallet replaces the actual cards and comes as a secure way to make payments. Since most people go with their phones almost everywhere, it gets assured of quickly accessing funds wherever and whenever necessary, making online banking quite efficient and reliable. Also, individuals get to go cashless in instances where ApplePay, Google Pay, and Samsung Pay get accepted, which further eases up the payment procedures and options.

Alerts

Business engages in multiple transactions which facilitate their operations and service provision to their customers. Online banking comes with the possibility of setting up digital business banking services that inform account owners of any deposits or withdrawals that take place in their accounts through setting up emails, texts, and push notifications to detect activity. Digital business banking facilitates real-time alerts for login attempts and other fraudulent activity, which keeps the account owner well-informed on the account activity at all times. Additionally, there are customizable alerts for improved security, giving the account owner peace of mind about the safety of their finances.

Bill payment

Online banking allows businesses to manage their bill payments without any challenges easily. Businesses manage the costs through their mobiles and computers anywhere and anytime; hence they stay on time with their payments. Additionally, digital business banking enables businesses to schedule one-time and recurring payments, which works to settle the business bills without failure. Also, there is the possibility of adding multiple users and assigning different access levels. Also, business owners link their invoices and discount information with their payments, making it easy to trace their expenditures at all times. The numerous benefits and features of online banking make it an essential tool for every business.